Personal savings

Get your money working for you.

Start with a little as £100 or from £50 a month via direct debit

Create as many savings pots as you want for different goals

See which investment funds are performing best and easily switch

Make it even easier with a ready-made portfolio to get you started

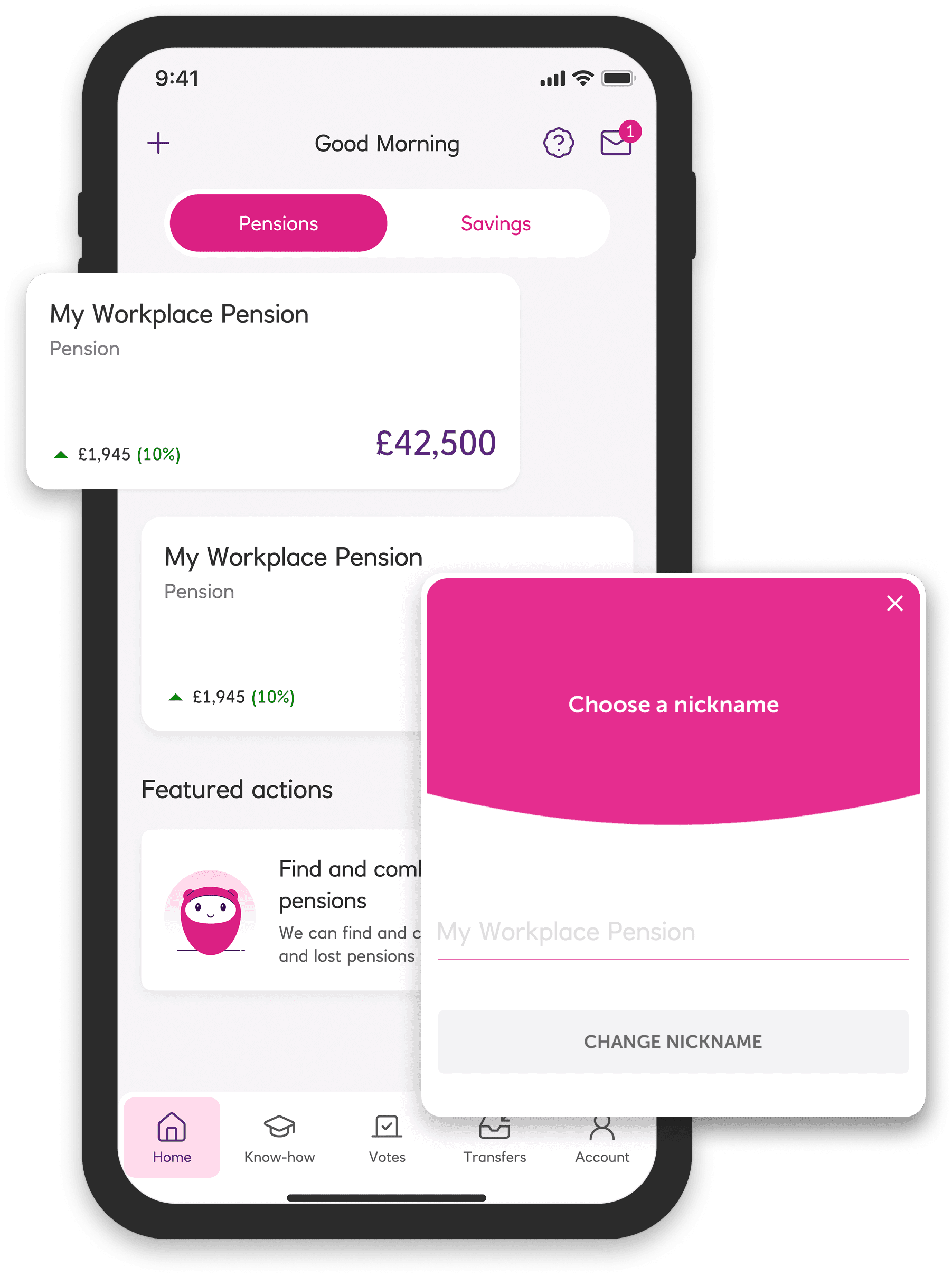

Check, manage and access your money with our friendly app

Capital at risk. All NatWest Cushon ISA products are Stocks and Shares ISAs. The value of investments can fall as well as rise, and you may get less than the full amount you invest.

Getting started with NatWest Cushon is easy

Solutions to suit all your savings goals

Our app brings it all together in one place, so you can check and make changes whenever you like, wherever you are.

The figures shown are for illustrative purposes only

Individual Savings Account (ISA)

A Stocks and Shares ISA is an account that lets you hold cash and/or investments without having to pay tax on any interest, investment income or gains you make on your money.

- A simple way to help build healthy savings habits

- Hassle-free saving straight from your bank account

- Comes with access to jargon-free help and ideas that bring money management to life

Getting started or switching to NatWest Cushon is easy

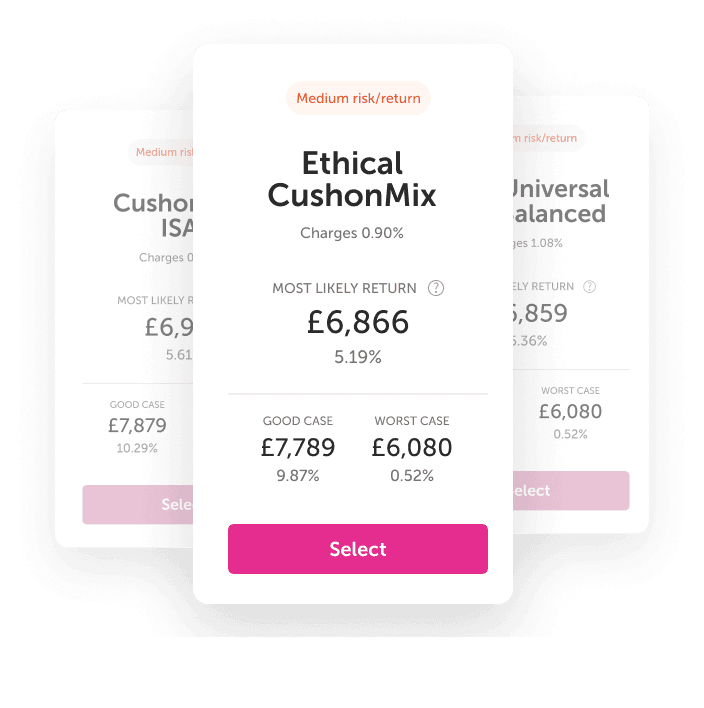

Ready-made, optimised investment portfolios

Our ready made portfolios make it easy to start with Stocks and Shares ISAs.

- Choose the right level of risk for you

- No complicated decisions to make

- Do it via the NatWest Cushon app

The figures shown are for illustrative purposes only

Getting started with NatWest Cushon is easy

You can trust us

Safe

NatWest Cushon is part of NatWest Group. We are authorised and regulated by the Financial Conduct Authority (FCA) and The Pensions Regulator (TPR).

Secure

Privacy and security is our priority. We use the highest levels of encryption and the most robust financial industry standards for securing our app and website.

Fair

We keep our charges transparent and fair. There is a simple %-based cost for investing with NatWest Cushon, and no hidden fees.

You may also like...

Blogs

78% of UK adults are missing out on tax-free savings

Recent data from the Office for National Statistics found that 78% of adults in the UK do not have an ISA [¹].

NatWest Cushon

Blogs

40% of adults are saving to have money to fall back on

When it comes to savings goals, 40% of adults are saving to have money to fall back on. Of that 40%, more women than men are saving to have a financial buffer in place to better prepared if the unexpected were to happen.

NatWest Cushon

Blogs

Flexibility in savings is key

Royal London’s Steve Webb once said he would not be sad to see the back of the Lifetime ISA (LISA), describing it as a "confused product" because it tries to support both long and short-term investment tactics in its bid to help savers work towards buying a house and save for retirement.

NatWest Cushon

Blogs

Cost of living - energy saving tips

We’re about getting people saving but we’re also here to help our customers become less stressed about money. We’re about straight talking...so here it is!

NatWest Cushon

Frequently asked questions

There's no charge for employers.

Members pay an Annual Management Charge or 'AMC'. This is a small percentage starting at 0.69% and depends on the investments they select.

No. We are open to all organisations of all sizes.

If you've just hired your first employee, you'll need a workplace pension to comply with your auto enrolment duties - so we've made it easy to apply.

Most applications only take a few minutes.

If you're short for time, we only need some information about you and your company to save your application in case you need to return to it later.

We need information that you will already know about you and your organisation.

This includes information about you, your organisation, who will be running your workplace pension and when you want it to start.

Very safe.

Cushon Master Trust is authorised and regulated by the Pensions Regulator. Members' savings are legally protected by a trust management. We are chosen by employers across the UK to help their employees confidently save for the future.

Importing employees and contributions into your payroll through the Cushon Employer portal couldn't be easier. We have created a guide to help you understand the supported file formats and the upload process.

You can download the NatWest Cushon app on the Apple App Store or the Google Play Store. Alternatively, you can access our member portal.

If you have a pension with us and are logging in the app for the first time, you'll need the unique 6-digit one time access code that has been sent to you in your Welcome Pack.

For your pension account, this is your National Insurance Number.

Forgotten your password? Click here and follow the simple steps to get a new one.