Who gets your money if you die?

This article explains what happens to your pension savings after you're gone, and how you can direct the money to the people or places you want to receive it.

Pension savings don't just disappear if you die before taking them all - but they aren't automatically covered by your will.

If you have any amount of pension saved, it's a very good idea to let us know who should be next in line to get it.

What happens if you don't nominate anyone?

If you don't do this out trustees will decide on your behalf who gets the money you've saved. This might be the person or people you would like to benefit - but why leave that to chance?

Nominating a beneficiary means...

Telling us who should get your pension savings if you die before you reach retirement and/or have used all your savings.

Your pension savings can go to who you want

If you die before taking your pension, or before you have used it all, someone else will get it. Often that would be your next of kin - your closest living relative. However, it does not have to be them, or even someone you are related to. You have the right right to choose exactly who gets your savings - the beneficiary - should you die with pension money in the pot. It could be your unmarried partner, a friend, a neighbour.

Your money can go to more than one person

Just as you can choose who gets your money, you can choose to give it to more than one person. You simply add as many people as you would like to have a share, ands tell us what proportion of the funds each will be entitled to.

Your money can go to different places too

Your pension money can also go somewhere other than a person, such as a charity. Or you could assign some to a charity, and some to an individual person, or people.

All you have to do is tell us who and how much

Once you have thought about who or where it is who you would like your money to go, you can easily let us know via the Cushon app.

Step 1

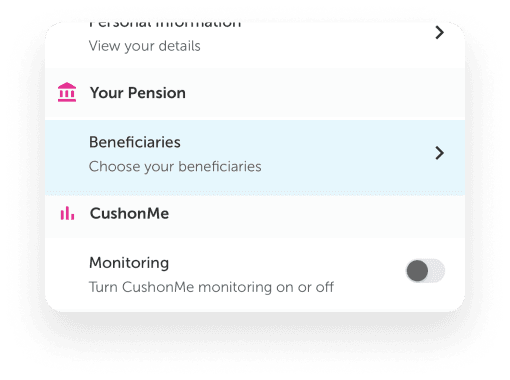

Select the wheel in the top right hand corner of the app main screen

Step 2

Select 'Beneficiaries' from the Settings menu

Step 3

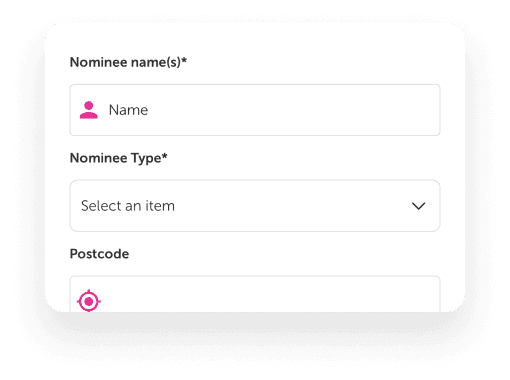

Add a new (or edit an existing) beneficiary and follow the instructions

FAQs - Nominating a beneficiary

If you die and there is still £ in your pension, it will go to your nominated beneficiary. It’s up to you to choose someone and make sure your pension provider knows who they are. Whatever happens, your money won’t just disappear. If you don’t make a nomination your money will still be passed onwards to your relatives, but the trustees of the pension will need to decide who should get it, and it’s possible their choice won’t be the same as who you would have chosen. So why leave that to chance?

Your nominated beneficiary is the person you choose to receive your pension money when you die.

You can nominate anyone, but people often choose their partner or a close family member or friend. You can nominate more than one person and divide what you leave into larger or smaller percentages. Some people leave their pension to a charity or good cause close to their heart.

When you were enrolled with us we'll have asked you to let us know - but you may not have done so. It's easy to check by taking a look in the Cushon app.

It's an easy bit of admin to tick off your list. You can do it all in the app in just a couple of minutes and there is no offline paperwork required.

Not a problem. (In fact we like it when people update their details with us - it helps us know our information is accurate and up-to-date.)

You can change your beneficiary nomination as often as you like - use the app. It takes a few moments and there’s no paperwork.

As many as you like. And you can leave different proportions to different people as long as it totals 100%.

So for example, you might choose three people and divide the pot 25% / 25% / 50% between them.

You can also nominate different beneficiaries for different pension pots if you have more than one.

Remember to review your choices after big life events, such as marriage, divorce, births and deaths.

That's a good question to ask. If you’ve been enrolled in different schemes or changed jobs frequently, it’s important to find out who your beneficiary is for each pension scheme. Pension pots from years or even decades ago may not have the right beneficiary listed.

You may or may not have kept track of all your old pension pots. It could be worth spending time on this and tracking them down – it's your hard-earned money, after all.

It could be simpler to transfer all your pots into one, depending on the type of pensions you’ve had in the past. We can help with this and it’s free and easy to do through the app.

Yes, but we will only be able to pay out to them if a trust or other suitable arrangement has been set up for them.

This communication is for information purposes only and is not personal advice. The value of investments can fall as well as rise, and you may get less than the full amount you invest.

Article by

NatWest Cushon Explainer

More explainers

Financial know-how

Three things to think about when setting your target age

This article explains what a target age is, and the most important things to consider when working out the right target for you.

NatWest Cushon Explainer

Financial know-how

How we invest your money over time

This article explains how pension investments work, what your money is invested in, and why the way your money is invested changes over time.

NatWest Cushon Explainer

Financial know-how

Why and how to transfer your old pension pots to Cushon

This article explains why you might consider bringing your different pension pots together, and how easy it is to do with the Cushon app. (You don’t even need to know where your pots are!)

NatWest Cushon Explainer

Financial know-how

Where we invest your money

This article explains why your money is invested differently with Cushon and how our approach is designed to reduce the risks from climate change.

NatWest Cushon Explainer